SlimSensor - Licensing Business Opportunity

Global electricity distribution networks are becoming more stressed as more low-carbon technologies such as renewable generation, heat pumps and electric vehicles are connected to the...

View Case Study

Sensus Smart Electricity Meter

Sensus, a leading US water meter manufacturer, were approached by Sentec with a prototype solid state electricity meter. Sensus chose Sentec's technology to enter a new market for them,...

View Case Study

Sensus iPerl Smart Water Meter

Sensus contracted Sentec for an update of their water meter product line, with the goal of expanding Sensus’ products range to enable them to define the new market of smart water...

View Case Study

Technical Due Diligence for UK Smart Meter Rollout

Smart metering has been a major theme in the residential water and energy sector for many years, driven by regulations on energy distribution and by the need to manage growing demand for...

View Case Study

Actuator Technology– Advanced Fuel Injection

Sentec's unique fuel injection technology allows a very high degree of control and flexibility. It provides a route to de-risking unknown future emissions standards requirements and opens...

View Case Study

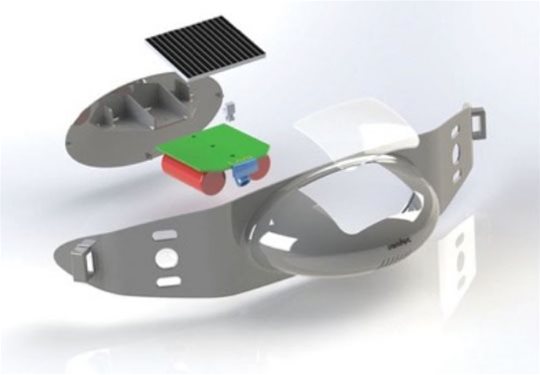

Solar Owl – Innovative Noise Pollution Monitor

A study from the World Health Organisation found that long-term exposure to noise may account for 3% of deaths associated with heart disease and stress. Noise is a particular problem in urban areas...

View Case Study

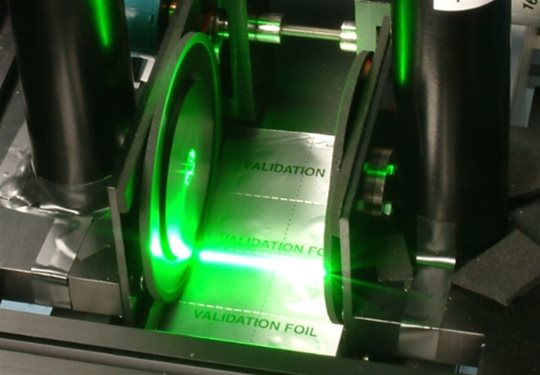

Manufacturing Equipment for Pharmaceutical Packaging Inspection

In the pharmaceuticals industry, the claim of 100% testing, and the possibility of agreeing longer product shelf life as a result, can lead to significant commercial advantage. Traditional,...

View Case Study

Manufacturing Equipment Development

Sentec has developed techniques and the equipment to perform tests of both components and products. These designs have been delivered to customers as fully operational, CE approved and ruggedised...

View Case Study

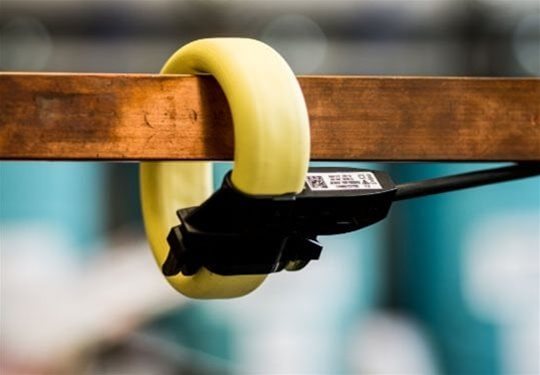

Multi I Probe – AC/DC Multi-Conductor Current Sensor

Sentec has developed a new technology called Multi I Probe for AC/DC that enables up to 5 simultaneous current measurements with a single probe. This low-cost technology can identify the core...

View Case Study